1. Assign Salary to Staff

Each staff member can have a different salary type assigned to them based on how you compensate them. These salary types define how the system will compute the salary at the end of the month.

2. Salary Computation at Month-End

At the end of each month:

- Go to the Staff Salary page

- Click on the COMPUTE SALARY button

- spynPRO will calculate each staff member’s salary based on their assigned salary type

You can adjust the salary before marking it as paid. Once paid, it is automatically recorded as an expense in the Expense module.

3. Salary Types Explained

Fixed Salary

Description: A fixed monthly amount

Example: ₹30,000 per month

Based on Days Present

Description: Daily rate × number of days present

Requirement: Staff must check-in

Example: ₹500/day × 20 days = ₹10,000

Based on Sessions Present

Description: Per-session rate × number of sessions present

Requirement: Staff must be marked present in class schedule

Example: ₹200/session × 15 sessions = ₹3,000

Checked-in Hours

Description: Hourly rate × total checked-in hours

Requirement: Staff must check-in and check-out

Example: ₹100/hour × 100 hours = ₹10,000

Revenue-Based

Description: Percentage of revenue generated through sessions

Formula:

Salary = Share % × Sum of (All client sessions × Per session cost)

Example:

- Staff share = 20%

- Session 1:

- Client 1: ₹1000/20 sessions → ₹50 per session

- Client 2: ₹600/10 sessions → ₹60 per session

- Session 2:

- Client 1 again: ₹50 per session

- Calculation: 20% × (₹50×2 + ₹60×1) = ₹32

4. Adjust Staff Salary

To make adjustments:

- Go to the Staff Salary page

- Select the staff member

- Click Edit Salary

- Enter adjustment:

- Use

+2000to add (e.g., bonus) - Use

-2000to deduct (e.g., leave deduction)

- Use

- Optionally, add a note for clarity (this appears on the salary slip)

- Click Save

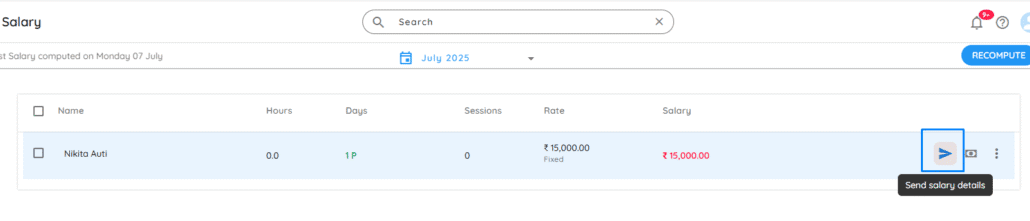

5. Send Salary Slip to Staff

- Go to the Staff Salary page

- Hover your mouse over the staff member’s row

- You will see the Send Salary Details icon appear

This sends the salary slip to their registered email.

You can also send slips in bulk to multiple staff from the same page.

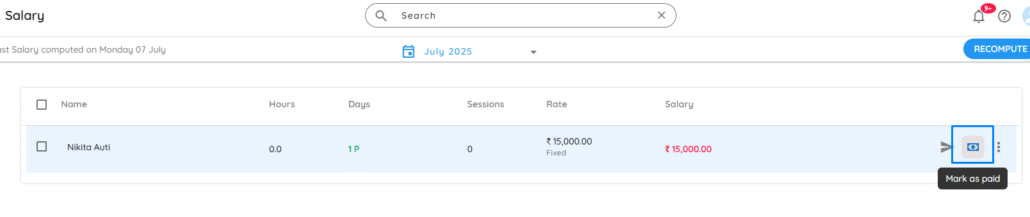

6. Mark Salary as Paid

- Go to the Staff Salary page

- Hover your mouse over the staff member’s row

- You’ll see an icon appear – click on Mark as Paid

- Choose:

- Payment mode

- Paid date

- Paid by

- Optional note

- Click the Mark as Paid button

Once marked as paid:

- It’s recorded as an Expense

- The salary can no longer be edited, but you can delete and recompute it if needed

7. Change/Edit Paid Salary

You can’t edit a paid salary directly, but you can delete and reprocess it:

- Go to the Staff Salary page

- Hover over the staff member’s row

- Click on the three dots (⋮) icon

- Select Delete Salary

- Click COMPUTE SALARY again

- Make any necessary adjustments

- Save and send the updated salary slip