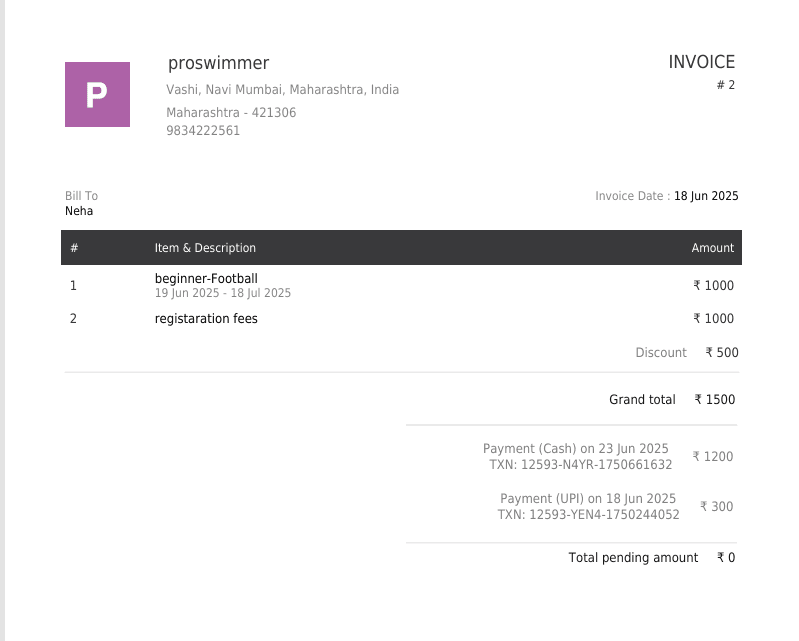

Here’s a sample of the invoice your subscriber will receive.

Invoice Format & Tax Settings

The invoice will be labeled as a “TAX INVOICE” if tax settings are enabled.

If taxes are not enabled, it will simply display “INVOICE”, and all tax-related fields will be hidden.

📋 Key Components of the Invoice

- Logo

Upload your company logo in Settings > Business Details. - Company Name & Address

Ensure your business name and address are updated correctly in Settings>Organization. - Tax Number

Go to Settings > Tax Settings

- Enter the Tax ID Name (e.g., GST)

- Enter your Tax ID Number

- Click Save - Invoice Date

Displays the invoice date of the subscription plan. - Invoice No

Automatically generated and unique to each invoice. - Plan Details

Shows the plan details and includes any one-time plans associated with the selected period. - Tax

If tax is enabled, this section will display the breakdown of applicable taxes.

The plan amount shown will include tax values.

🛠️ How to Add Tax in the System

To apply tax, go to:

Settings > Tax Settings > ADD TAX, then fill in the following:

- Tax Name: Enter the applicable tax name (e.g., CGST)

- Percentage: Specify the tax rate (%)

Click Save to apply the changes.